We typically invest our hard-won capital in a ‘portfolio’, which is usually composed of a selection of funds, diversified to manage risk. Your objectives when making an investment probably enable a future life changing event – giving up work, paying for something important, or giving your children a helping hand.

What many don’t realise is that maximising the performance of your portfolio within your risk parameters is the single most important factor to successfully achieve your objectives. If your objectives are life changing, they’re important.

Poor investment performance over time could mean the difference between retiring with an income of £30k per year versus £50k per year with good performance. Which would you choose?

Presuming that the higher number is everyone’s choice, and we’ve established the importance of good performance, how should you proceed? Would you build a portfolio yourself, entrust it to a well-meaning amateur (and pay them), or employ the most effective performance-centred solution available in the market?

To determine what good performance looks like, you need to start by analysing and measuring investment portfolio returns (and risk) to see if your portfolio is worthwhile. Understanding your portfolio’s performance and measuring it against relevant benchmarks is challenging for most people, and surprisingly, even for many financial advisers.

While it’s rarely intentional, this lack of understanding by financial advisers can lead to misinterpretations, giving you a false sense of security about the quality of your investment solution.

Financial advisers are typically good at financial planning. However, if they don’t understand the nuances of investment performance reporting, can you rely on them to build and maintain an effective portfolio? Or are they simply well-meaning amateurs?

One of the most critical aspects of understanding investment performance is selecting an appropriate benchmark. Benchmarks serve as a reference point, helping to determine if your investment strategy is genuinely adding value. However, the wrong benchmark can be as misleading as an overly optimistic report. For instance, if a benchmark is chosen that does not accurately reflect the reality of your investments, the relative returns of your portfolio will be distorted.

Ideally, you should use industry-recognised peer group benchmarks such as the STEP Managed Portfolio Indices (MPI) or ARC Private Client Indices (PCI). This ensures that your portfolio performance is measured accurately against averages of organisations managing money, in other words lots of portfolios like yours, with similar risk parameters.

On the surface, comparing portfolio returns seems straightforward. However, a common reporting error is confusing a portfolio’s historic returns with the back-tested performance of a selection of funds picked today. This might seem nuanced, but it’s a crucial distinction.

Investment managers make changes to portfolio assets over time, adjusting to evolving markets and economies. Portfolio-level reporting provides a comprehensive review of the actual performance over time, reflecting each change to underlying holdings and manager-driven adjustments to asset allocation. It represents the intellectual capital invested in navigating market conditions.

In contrast, many financial advisers present the back-tested results of recently selected funds, represented as historic portfolio performance. They believe this approach is sound, but it is fundamentally flawed. There is no comparison between these two methodologies – one is right, the other wrong.

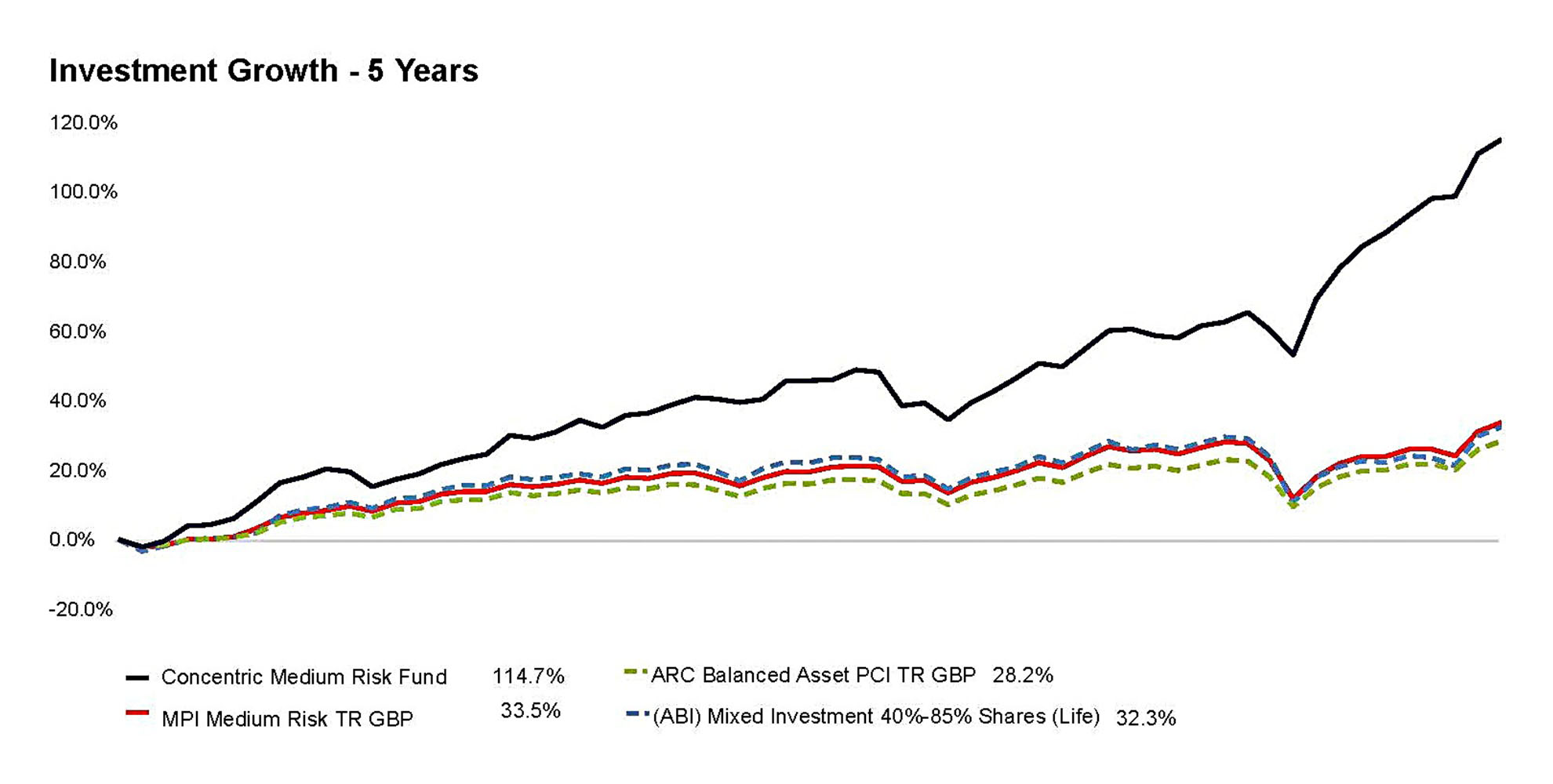

Consider a real-world example: an adviser’s chart showing their portfolio supposedly doubling the return of a peer group index. Is that plausible, or would you question it? The index represents thousands of discretionary managed portfolios, managing perhaps a trillion dollars in aggregate. Are we to believe three advisers have consistently outperformed that entire group? If so, why aren’t they leading Goldman Sachs, or considered the new Warren Buffett? See our example for the ‘Concentric Fund’ created by the same back testing process.

The answer, of course, is that these reports warrant close scrutiny. They reveal a fundamental lack of understanding of proper portfolio reporting among many advisers, which can become a long term issue if you invest with them.

A more effective solution for managing portfolios is Discretionary Investment Management. Discretionary managers are investment professionals dedicated to making informed choices on an investor’s behalf, based on a predefined strategy, and allowing for timely adjustments in response to market fluctuations. Their only job is to manage money and position portfolios for future success, and many excel at it.

If your financial adviser is using a discretionary manager, that’s a positive step. However, how does your adviser select that manager if they struggle to analyse the data to compare performance history? Are they picking a manager below average for the peer group? It’s a 50/50 chance they are…

You should expect effective, transparent reporting from those advising you on your investments.

When reviewing portfolio report providers, pay attention to the quality of the charts, tables, and data. Is it showing your portfolio’s performance over time, or simply a selection of today’s best funds blended into a chart? Does it look too good to be true? Does it mention how much risk has been taken? Ratios can also be highly informative, helping to distinguish returns generated by smart investment decisions from those resulting from excessive risk. Understanding these metrics provides a clearer picture, enabling you to make better decisions.

At Concentric, we are committed to providing comprehensive reports that reflect the true performance of your portfolio. Our team of analysts produces over 1,000 trust, charity, and private client reports each quarter. We avoid misleading practices, ensuring that you always have a clear understanding of your portfolio’s performance against peer group benchmarks.

If you’ve read this far, you’re probably curious about how Concentric approaches portfolio reporting and investment manager selection. Simply put, our goal is for your portfolio returns to exceed your objectives over the long term.

Our ethos is to bring together the best solutions, aiming to provide you with a top-quartile discretionary manager that delivers consistent outperformance over their peers. Our analysis and processes identify which manager this should be. Through this rigorous analysis and reliable data, we use our proprietary service to select only the best discretionary managers. Crucially, we also know when to replace those who are fading, moving you to the next star performer.

The weight of our investments with star managers allows us to provide these solutions at a much lower cost than you might expect.

At Concentric, we analyse your financial objectives and create performance centred solutions. Whether you’re a private client, charity, or trustee, our expertise and deep understanding of investment portfolios, pensions, and treasury services can help you achieve exceptional results.

In an industry where misleading reporting practices create confusion, working with professionals who prioritise transparency and clarity has never been more crucial. It’s not just about the numbers — it’s about their interpretation and knowing that your investments are in good hands.

So, now you know what to look for in an investment solutions provider, we hope you feel empowered to make informed decisions about your financial future. Or you could just pick up the phone to us.

Concentric Financial Services Limited is regulated by the Jersey Financial Services Commission to conduct investment business under the Financial Services (Jersey) Law 1998. 3rd Floor, Conway House, St Helier, Jersey, JE2 3NT

Concentric Group

3rd Floor

Conway House

St Helier

Jersey

JE2 3NT

Concentric Guernsey

Windsor House,

Lower Pollet,

St Peter Port,

Guernsey,

GY1 1WF

A TEAM plc company

© 2025 Concentric | Website by The Collective

Concentric Financial Services Limited is regulated by the Jersey Financial Services Commission to conduct investment business under the Financial Services (Jersey) Law 1998.

Concentric Financial Services (Guernsey) Limited is licensed and regulated by the Guernsey Financial Services Commission.